Key Takeaways

- The SEC filed a brief appealing a court ruling that found XRP was not a security when sold to retail investors.

- The SEC seeks to overturn the district court’s ruling and classify all XRP sales as unregistered securities offerings.

Share this article

The SEC on Wednesday filed an opening brief in its efforts to get the US Court of Appeals for the 2nd Circuit to overturn a previous court ruling that found XRP was not classified as a security when sold to retail investors.

In a July 2023 ruling, Judge Analisa Torres of the US District Court distinguished between XRP sales, determining that those on exchanges were not securities, but sales to institutional investors were. Following this ruling, a final judgment last August ordered Ripple to pay a $125 million civil penalty for institutional sales of XRP.

The SEC later decided to proceed with an appeal, aiming to challenge the court’s ruling that secondary market sales of XRP tokens were non-securities.

In the brief shared by defense lawyer James Filan, the SEC contends that both institutional and retail XRP sales meet the criteria for investment contracts under the Howey test. The regulator reiterated that Ripple’s sales of XRP, totaling over $2 billion, were unregistered investment contracts and violated federal securities laws.

The appeal challenges the district court’s distinction between institutional and retail investors. The SEC argues that this distinction contradicts the Howey test’s objective standard, which focuses on the economic realities of the transaction and what a reasonable investor would understand about the investment opportunity, not the specific identity of the seller.

The SEC asserts that Ripple’s public marketing campaign promoted its efforts to increase XRP’s price. The regulator claims that the campaign reached all investors, both institutional and retail, leading all purchasers to reasonably expect profits based on Ripple’s actions.

Due to this, the SEC contends that the lower court’s distinction between “sophisticated” institutional investors and “less sophisticated” retail investors was invalid and violated the Howey standard.

“All XRP investors — not just institutional investors who purchased XRP knowingly from Ripple — reasonably expected profits from Ripple’s efforts to increase the price of XRP,” the brief states. “That distinction is contrary to Howey’s objective standard,”

The SEC also disputes the district court’s finding that Ripple’s transactions involving non-cash consideration, including XRP paid to employees and business partners, do not qualify as investment contracts. The appeal argues these transactions satisfy the “investment of money” requirement.

The regulator seeks to reverse the district court’s final judgment that favored Ripple and establish that all XRP sales qualify as unregistered securities offerings.

If successful, the case would return to the district court. There, a judge would decide what further actions to take against Ripple and whether its top executives helped break securities laws when XRP was sold to investors. The SEC also aims for “additional remedies,” which could include increased penalties.

SEC prepares to overhaul crypto policies under Trump

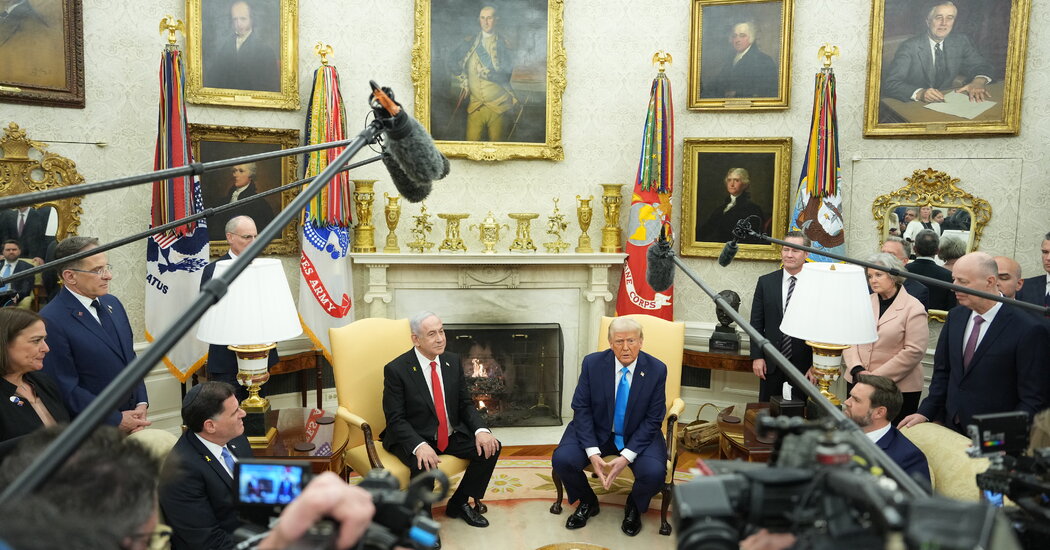

The brief comes amid growing optimism about Trump’s anticipated re-entry into the White House next Monday, which also happens to be the day SEC Chair Gary Gensler officially steps down.

Industry leaders and experts see a strong chance that legal enforcement actions initiated under Gensler’s leadership could reach a dismissal or settlement.

SEC commissioners Hester Peirce and Mark Uyeda, under the incoming Trump administration, are set to reform the agency’s regulations, focusing on crypto asset classifications and potentially pausing non-fraud litigation.

The initiative, led by Paul Atkins, a likely future SEC Chair, aims to introduce more crypto-friendly policies. As part of this policy change, the SEC may rescind some existing guidance and revise the enforcement approach it has taken over the past few years.

Share this article