Last Updated:

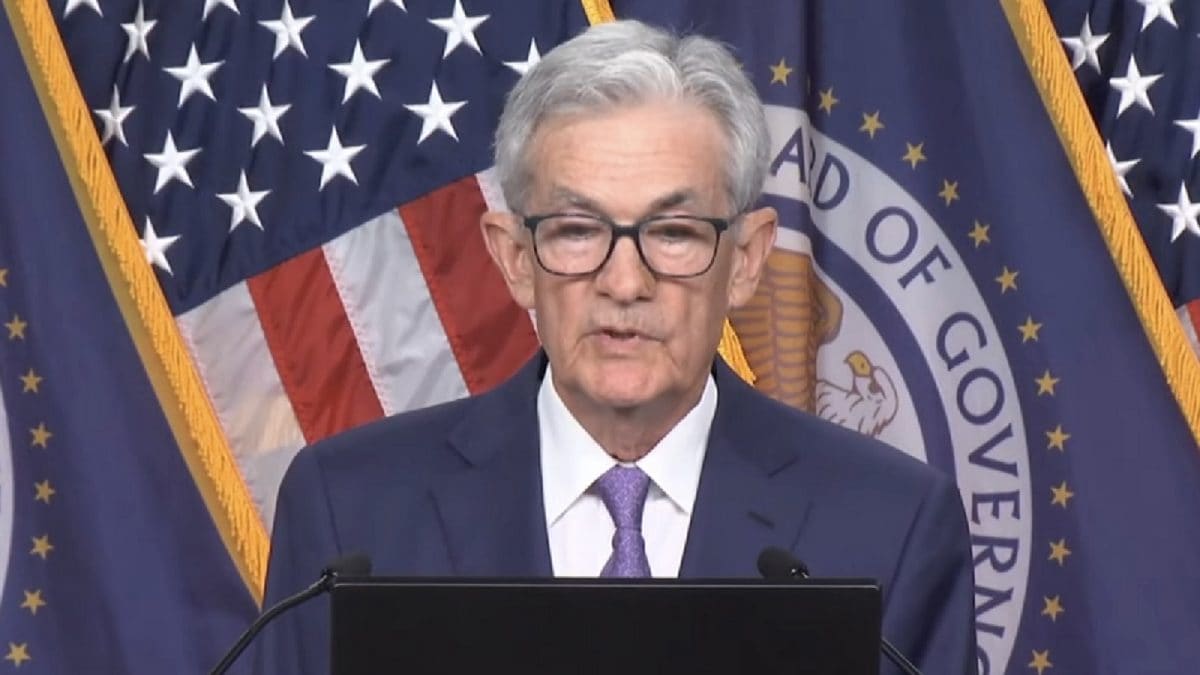

Following this, US Fed Chairman Jerome Powell is scheduled to address the media at 1:00 AM IST (2:30 PM ET), where he is expected to provide insights into the Fed’s outlook on inflation, growth, and potential policy shifts in the coming months.

US Fed Meeting Updates.

US Fed Meeting LIVE Updates: The US Federal Reserve is set to announce its first monetary policy decision of 2025 shortly, at 12:30 am IST. Market participants and analysts widely anticipate that the US central bank will maintain the current interest rates, keeping its benchmark rate steady as it assesses economic conditions.

Following this, US Fed Chairman Jerome Powell is scheduled to address the media at 1:00 AM IST (2:30 PM ET), where he is expected to provide insights into the Fed’s outlook on inflation, growth, and potential policy shifts in the coming months.

Ahead of the policy decision, the US markets were trading lower with the Dow Jones down by 0.17 per cent and the Nasdaq trading lower by 0.78 per cent. The US Dollar Index was trading marginally higher by 0.05 per cent at 107.92, while the US 10-year bond yield was slightly up at 4.557 per cent.

Investors, economists, and policymakers worldwide are closely monitoring the Fed’s decision, as it holds significant implications for global financial markets. With inflation showing signs of moderation and economic growth steady, analysts believe the Federal Open Market Committee (FOMC) will adopt a wait-and-watch approach before making any rate cuts. The focus will be on Powell’s commentary regarding future monetary policy, particularly the possibility of rate cuts later this year.

The US Fed on December 18 announced a cut in the key interest rates by 25 basis points to 4.25-4.50 per cent. It was the third rate cut by FOMC in three months, with the first rate cut announced in September (by 50 basis points) and second in November (by 25 bps). The first cut in the current rate cut cycle came in September after a gap of four years.

In December 2024, the US Fed projections had shown two quarter-point interest-rate cuts in 2025.

The central bank implemented aggressive rate hikes in 2022 and 2023 to combat soaring inflation, which peaked at 9.1% in mid-2022. However, inflation has gradually cooled, coming closer to the Fed’s 2% target.

Today’s decision and Powell’s remarks will set the tone for the Fed’s stance in the coming months. A dovish outlook could bolster equity markets, while a more cautious tone may affect it adversely. The global economy, especially emerging markets, will also react to any signals regarding future US monetary policy.