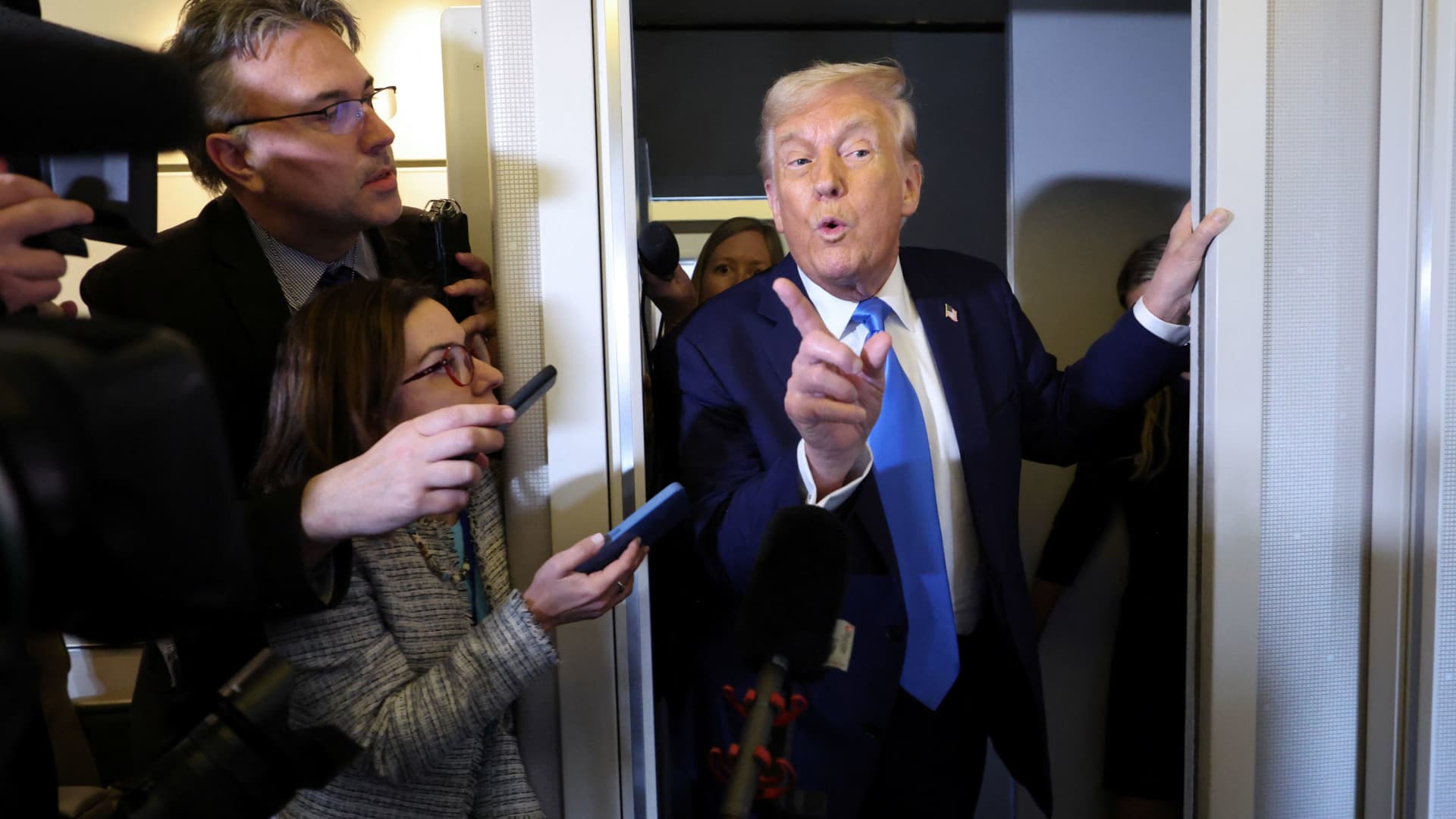

The price dip follows Ripple’s decision to drop its cross-appeal against the U.S. SEC. Ripple announced on March 25 that it would end its appeal, reducing its fine from $125 million to $50 million. The legal case, which lasted four years, is now officially closed. However, XRP failed to rally after the announcement, surprising many traders.

Ripple’s CEO and legal chief highlighted the positive outcome, but the market remained flat. Experts believe traders may have already priced in this news earlier, leading to profit-taking instead of buying.

Weakness in XRP’s derivatives market also adds to the pressure. Open interest has dropped 52% since January, now sitting at $3.82 billion. Funding rates also turned negative on March 27, suggesting bearish sentiment. Negative funding rates mean short-sellers are willing to pay to keep their positions open, signaling more downside risk.

Technically, XRP confirmed a bearish pattern called a “bear flag.” The price is testing support at $2.30, with $2.22 and $2.00 as critical levels. If sellers push below these levels, XRP could slide toward $1.60, marking a 31% drop from current prices.

Analysts warn of even deeper losses if bearish patterns play out, possibly targeting $1.07 unless XRP can climb above $3.