With inflation cooling and jobless claims shrinking, crypto traders are betting big on the FOMC odds and Federal Reserve rate cuts by 2025. Add in sluggish economic signals and a jump in Treasury demand, and the narrative of a policy shift from Fed Chair Jerome Powell is gaining serious momentum.

But will it happen? As the old myth goes, no cuts until Punxsutawney Powell sees his shadow. Here’s when rate cuts are most likely to happen.

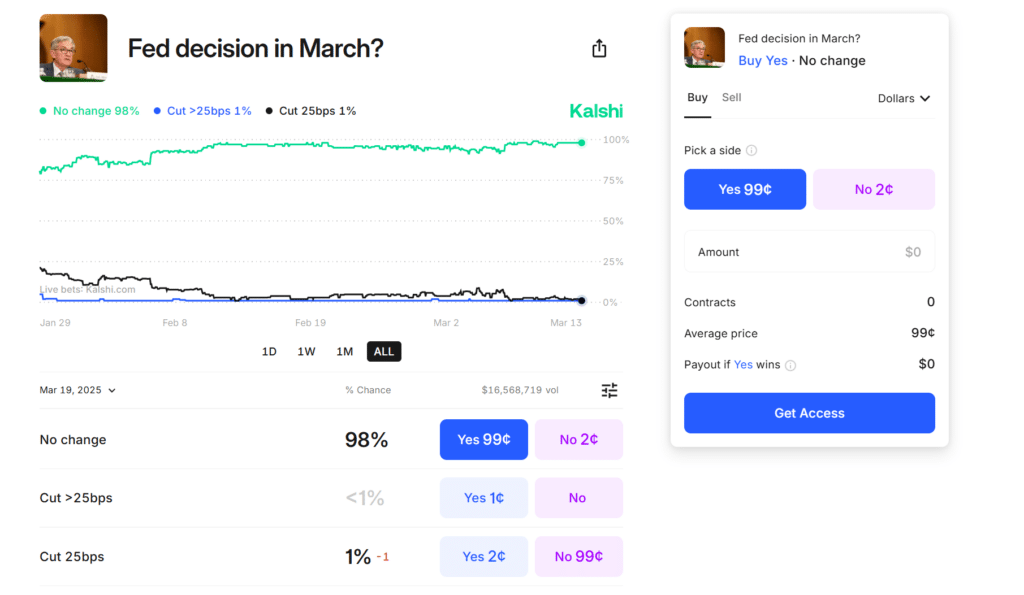

FOMC Odds: Flat Producer Prices and Falling Jobless Claims in Focus

February’s U.S. producer prices were dead flat, defying market forecasts. Pair that with a dip in weekly jobless claims, and you’ve got a labor market standing firm despite the backdrop of trade anxiety.

The shift was immediate. Odds of a June Federal Reserve rate cut shot up to 75%, with traders now expecting as many as three by year’s end.

its going to be hilarious seeing the bipolar shift on the tl when the data comes out that:

inflation is at a historic record low

illegal crossing is at a historic record low

new jobs being created at all time highs+ add FOMC money printer go brrr march 19th

patience anon $btc pic.twitter.com/RpB0fyU9qj

— TheMemeLord

(@TheMEMELordx69) March 11, 2025

Short-term interest rate futures and options activity reflect this building narrative. Call options tied to two-year Treasury notes have surged, with the premium on these bets hitting their highest levels since September. These positions would pay off if the Fed takes a more aggressive stance to rev up economic activity amidst the uncertainties caused by President Donald Trump’s trade agenda.

The Trump Administration’s Tariff Impact

The ongoing tariff increases from the Trump administration have added fuel to the speculation of rate cuts. Tough trade policies related to tariffs are squeezing consumer spending and creating “a ridiculous amount of angst,” according to CNBC’s Jim Cramer.

Retail is starting to crack, with companies falling short of their sales targets. As Cramer said, “We’re not out of the tariff woods.” The squeeze on consumer spending and the strain on businesses paint a bleak picture.

Cramer might not be right about a lot, but this might be one of the few times he’s on to something.

Another key figure adding weight to the possibility of rate cuts is February’s Consumer Price Index, which crept up just 0.2%, sliding under expectations. It’s a green light for the Federal Reserve to keep rate cuts in the toolbox, ready if the economy takes a turn for the worse.

The Nasdaq shot up 1.22% on the news, fueled by gains in tech, while the S&P 500 edged higher by 0.49%. Bitcoin is trapped between $79,000 and $82,000.

FOMC Odds: Treasury Markets Prepare for Cuts

This week’s cooler inflation numbers will set the tone for next week’s FOMC meeting. In addition, slowing growth under the weight of tariffs paints a dovish picture overall, with rumors of rate cuts growing more plausible by the day.

Jim Cramer argues that a timely Fed intervention could avoid a severe downturn. “There will be no serious recession,” he assures, but markets will remain on tenterhooks, watching every move from the central bank and the administration.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

- With inflation cooling and jobless claims shrinking, crypto traders are betting big on the FOMC odds.

- February’s U.S. producer prices were dead flat, defying market forecasts.

- The slowing growth under the weight of tariffs paints a dovish picture overall, with rumors of rate cuts growing more plausible by the day..

The post Is Powell About To Pump Crypto After FOMC Odds: CPI Data Sets Stage For Mega FOMC appeared first on 99Bitcoins.

(@TheMEMELordx69)

(@TheMEMELordx69)